- Rate and Term Refinancing: Having a performance and term re-finance, you earn an alternative home loan which have a diminished interest rate. And you can, when possible, a smaller fee name. Aforementioned, although not, depends on the market industry.

- Cash-out Refinancing: Which have a money-away re-finance, you could obtain as much as 80% of house’s really worth for the money. However, even if you score lower interest levels, the loan count you can expect to boost. This can lead to huge money otherwise extended loan terms and conditions.

Refinancing many times is not best. Although not, it can be done, just in case done properly can benefit you in the end.

Quite simply, you could potentially re-finance as often as you would like as long as it makes economic feel. Along with your bank might also want to allow it. However,, in addition, you need to be alert to brand new undetectable risks loans in Mcclave CO and relevant will set you back. Otherwise, youre destined to stop with additional financial obligation.

How frequently In the event that you Refinance Your home?

There’s no courtroom maximum on the level of times you can also be re-finance your home. However,, that isn’t smart to refinance your home once more and again inside a short period of energy. The choice, however, relates to numbers. The overall rule is you will be able to conserve money. As well as you to to occur, you should take into account the adopting the:

Waiting Several months

To own a normal loan eg speed and you will title re-finance, you do not have a standing period. However, for an authorities-recognized loan, you need to retain your financial for at least 6 months. Regarding bucks-out refinances, you would have to anticipate 6 months from the closure day. At exactly the same time, you will want to build sufficient guarantee in your home.

Besides which, the lender will also have good seasoning several months. During this period you simply can’t refinance with the same financial. This new flavoring period may be half a year adopting the closure big date. Yet not, it doesn’t mean which you don’t refinance using a special financial.

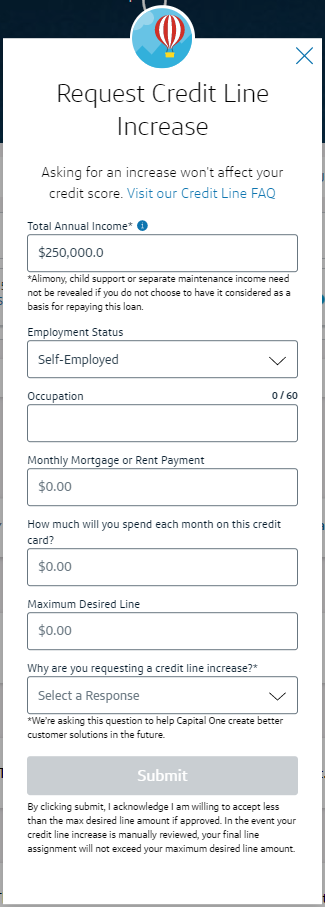

LENDER’S Criteria

Just like any other mortgage, firstly, just be able to meet the lender’s requirements. One thing may have altered throughout the history time you refinanced. You may have gotten a whole lot more personal debt, less credit history, or shorter income. Whatever it could be, it does apply at your own eligibility. Other variables that make up the fresh new lender’s requirements is the guarantee and DTI ratio.

Settlement costs

Refinancing is pretty similar to that of a mortgage. Where sense, you have to pay closing costs and this can be anywhere between 2% to 5% of your own financing dominant. Particular charge integrated was:

- Assessment Fees : Even though you had an assessment lately, your lender would also want another type of before refinancing. This is done to make certain that they pay depending on the value of your property and not continuously.

- Application Charges : No matter obtain a good refinancing or otherwise not, you pay an application percentage.

- Attorneys Opinion Charges : Pair says require a legal professional to review and you can undertake your loan. Such a meeting, you would have to spend attorney charges. The latest charge changes according to state you live in into the.

- Examination Fees : With respect to the county, you’ll be able to have to get your home examined. While you are a number of claims wanted an evaluation each time you re-finance, anyone else all of the 5-ten years.

- Name Browse and you can Insurance coverage : Yet another lender may need one buy brand new identity search to ensure this new ownership of the property.

PREPAYMENT Charges

Most lenders discipline your if you spend to settle their financial before the financing label finishes. Such as for example, state their financial has actually a term one to says you can’t shell out regarding the loan within this five years. For people who refinance their mortgage loan contained in this 5 years, you may need to shell out everything you features protected from inside the attention.